You’ve heard about NFTs, but you’re wondering how the marketplaces hosting these digital assets actually make their money. You’re not alone.

It’s a booming industry that’s not just about selling digital art. It’s about creating new revenue streams and changing the way we think about commerce.

Let’s dive into the innovative world of NFT marketplaces and uncover how they’re cashing in on this digital revolution.

Introduction to NFT Marketplaces

An NFT marketplace is where you can buy, sell, or mint NFTs, and it’s the core of the booming NFT industry. These marketplaces aren’t just platforms for trading; they’re innovative business models that generate significant revenue.

Understanding how they make money involves familiarizing yourself with title terms, description terms, and tokens. In essence, NFT marketplaces make money in a few ways. They charge fees for transactions, minting, and sometimes even for listing. They may also generate revenue through partnerships, premium features, and advertising.

The potential for profit in the NFT marketplace business is immense, and it’s sparking interest among innovators and investors alike.

The Basics of NFTs

NFTs, or non-fungible tokens, are unique digital assets. Unlike cryptocurrencies, each NFT is distinct, adding a layer of individuality to your digital portfolio. You can create an NFT from anything digital, but digital art is especially popular.

Each NFT transaction is verified using blockchain technology, creating a digital paper trail that adds to its authenticity and value. Understanding NFTs is crucial to navigate the burgeoning NFT business.

Primary Revenue Streams for NFT Marketplaces

So, you’re curious about how NFT marketplaces generate income?

Let’s discuss their primary revenue streams: transaction fees, listing and minting fees, and marketplace-specific tokens.

Royalties & (Sometimes also) Transaction Fees

You’ll find that royalties are the primary revenue stream for most NFT marketplaces. When you buy or sell a digital asset, these marketplaces charge a percentage of the sale price. This is how NFT marketplaces earn their keep and generate money to sustain their operations.

Now, let’s talk about gas fees. These are additional fees charged to cover the computational energy needed to process transactions on the blockchain. So, apart from the royalties of your NFT sales, you’ll also need to pay for gas fees on some NFT marketplaces that are not entirely decentralized, but more Hybrid. It might seem like a lot, but it’s the cost of doing business in an innovative, decentralized marketplace.

Listing and Minting Fees

Beyond the royalties and gas fees, there’s another layer of cost in the world of NFTs that you should be aware of – listing and minting fees.

You see, NFT marketplaces charge these as part of their NFT business model. When you’re minting the NFT, essentially creating your digital asset, you’re charged a minting fee. This pays for minting the NFT and is one of the ways NFT marketplaces make money.

Then there’s the listing fee, another charge you encounter when placing your NFT for sale on the marketplace. This, along with the transaction fee added when a sale occurs, forms the primary revenue streams for these platforms.

Marketplace-Specific Tokens

In addition to the listing and minting fees, you’ll find that some NFT marketplaces also use their own unique cryptocurrency tokens as another primary source of revenue. These marketplace-specific tokens are among the innovative ways that NFT marketplaces make money.

Different NFT marketplaces use their tokens to offer exclusive features, incentives, or voting rights, encouraging users to engage more and invest in these tokens.

If you’re planning to create an NFT marketplace, think about issuing your own token. It can act as a financial incentive, boosting user engagement and profits.

Remember, these tokens are part of the NFT marketplace features, which contribute to how marketplaces earn money.

In essence, these tokens offer a promising avenue to make your NFT marketplace more profitable and attractive to users.

Spotlight on Popular NFT Marketplaces

You’ve seen how NFT marketplaces generate revenue, now let’s put the spotlight on popular platforms.

We’re talking about the likes of OpenSea, Rarible, and SuperRare. These platforms have gained substantial recognition within the NFT community, but what makes them so successful?

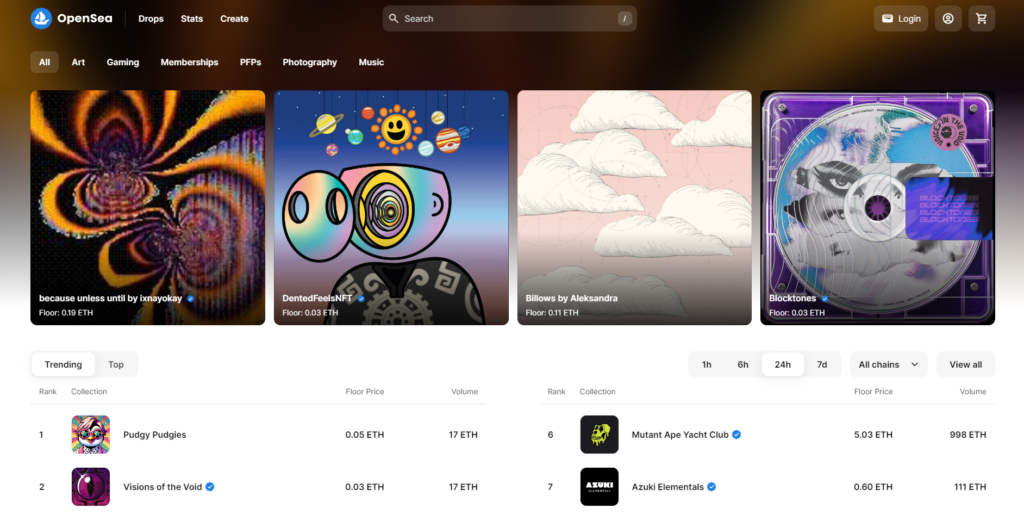

OpenSea

Let’s shift the spotlight to OpenSea, one of the most popular NFT marketplaces. Here, NFT sellers get a unique opportunity to sell their work and earn money, while the platform earns through commission fees. OpenSea has made NFT trading more accessible and profitable. It encourages innovation and creativity among users, fostering a profitable ecosystem. The platform gets a cut from each NFT for sale, creating a steady income stream. These strategies allow OpenSea to turn digital art into a booming business, where both creators and the platform benefit from the burgeoning NFT market.

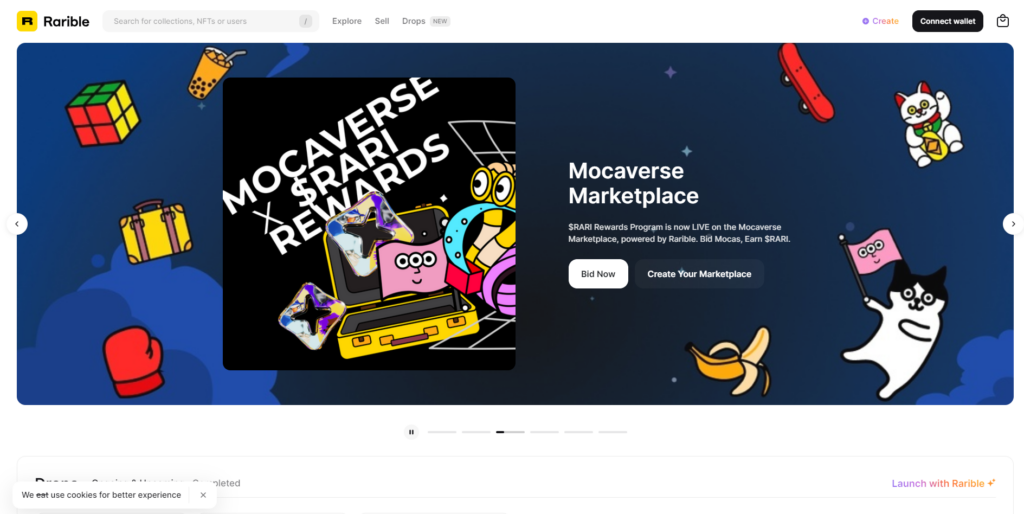

Next up, let’s dive into how Rarible, another NFT marketplace, generates income.

Rarible

While you might be familiar with OpenSea, another platform making waves in the NFT marketplace is Rarible, known for its unique transaction fee structure and its own token, $RARI. Rarible makes money by charging fees for every transaction. Whether it’s the initial sale of an NFT or when an NFT is resold, Rarible gets a cut. Now, let’s dive a bit deeper.

| Aspect | Explanation | Fees |

|---|---|---|

| Transaction | Rarible charges both buyer and seller | Variable based on the transaction amount |

| Blockchain | Rarible uses Ethereum blockchain | Gas fees for transactions apply |

| $RARI token | Used for transactions, governance, rewards | No direct fees, but potential investment cost |

But Rarible isn’t the only innovative player in this space. Next, we’ll explore SuperRare, another exciting NFT marketplace.

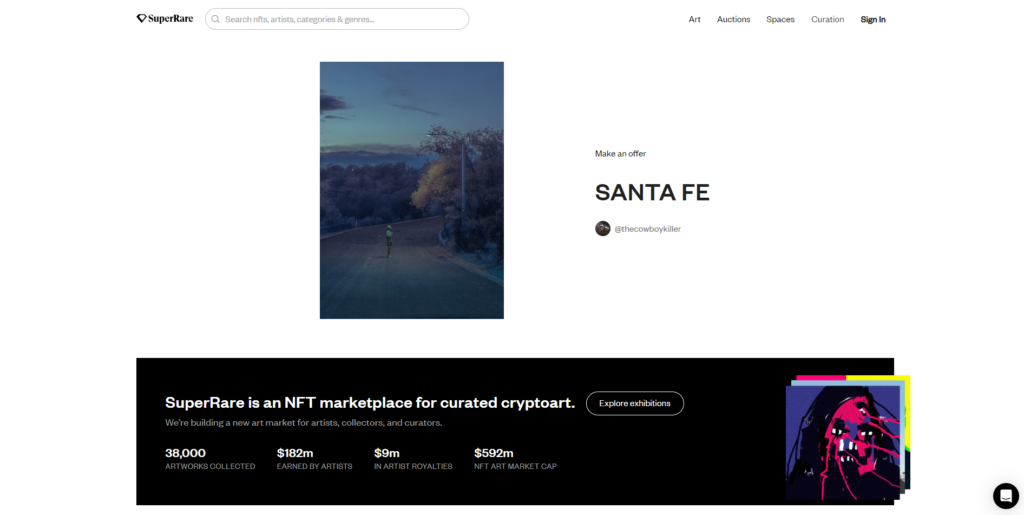

SuperRare

Moving on from Rarible, you’ll find that SuperRare also has a unique approach to making money in the NFT marketplace. SuperRare, one of the largest NFT marketplaces, stands out for its innovative fee structure. It charges a commission on primary sales and offers original artists a piece of the pie with royalties from secondary sales.

Here’s how SuperRare generates income:

- Primary sales: They take a cut whenever a unique NFT art piece is sold for the first time.

- Secondary sales: They make money from royalties every time an NFT is resold.

- Popularity: Being one of the most popular marketplaces for profitable NFT art, they attract a significant amount of traffic.

Next, let’s explore the impact of gas fees on these marketplaces.

The Impact of Gas Fees

In the world of NFT marketplaces, you’ll find that gas fees can significantly impact your profit margins, with costs incurred for minting, buying, and selling. When you buy an NFT, or someone sells an NFT, these fees are a part of the transaction cost. This can deter people from investing in the NFT marketplace, as the impact of gas fees can make it more expensive than originally planned.

Yet, don’t be dissuaded. Innovative, decentralized NFT marketplaces are working on solutions to these challenges. Some offer the ability to mint an NFT for free, removing the initial cost barrier. Additionally, by incorporating gas fees into their pricing structures, these marketplaces can generate additional revenue.

This approach helps maintain the vitality of the NFT ecosystem, despite gas fee fluctuations.

The Future of NFT Marketplaces

Looking ahead, your investment in the NFT marketplaces’ future could potentially yield significant rewards as they continue to innovate and diversify their revenue streams. Many NFT marketplaces like OpenSea and Rarible are exploring new ways to make money, taking the NFT space by storm.